Some company leaders might see these initiatives as nothing but sunk costs, but the truth is they actually offer a strategic advantage and a strong ROI. Nine out of 10 companies see positive returns from wellbeing programs, and 85% of CHROs agree they cut healthcare costs, according to our 2023 Return on Wellbeing Study. Yield ratio is just one metric that can be used to help you understand the impact of your recruitment strategies, and where you can find opportunities for improvement.

What is Yield Ratio? What is the formula and why it is important

Return on investment is equal to [earning – investment]/[investment]. Net Revenue Retention is a measure of the percentage of revenue retained by a company over time. Net Profit Margin, also known as profit margin or income margin, is one of the most popular metrics that can provide valuable insight into a… Opportunity Win Rate (OWR) is a metric used to measure the success of sales teams and organizations in converting potential…

Recruiting Yield Ratios Spreadsheet

Depending on the outcome of these ratios, you’re able to facilitate cross-sharing of knowledge among managers and recruiters. They can share best practices and techniques that produce the highest quality candidates. A further best practice would be to calculate recruiting yield ratios in your various departments (e.g., legal, IT, finance) and make a comparison. You may have heard of the term ‘yield ratio,’ which is often used in the corporate finance industry. However, a yield ratio is also an HR metric that greatly improves your recruitment and selection process. The more yield ratios decrease over time, the more efficient your process becomes.

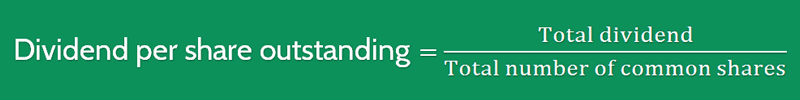

Calculating the Dividend Yield

For example, if you have a low Yield Ratio at stage 3, that might mean that your interview process needs some work. Yield Ratio is helpful in measuring the effectiveness of each stage in the entire hiring process by showing the ratio between those who applied and those who were selected at every step. Dividends can be awarded as additional stock, cash, or other forms of consideration.

- Dividends can be awarded as additional stock, cash, or other forms of consideration.

- The dividend policy can therefore provide insights into a company’s financial health and management’s confidence in future earnings.

- Implementing a quality assurance system in your production process can help improve yield ratios by reducing defects and rework costs.

- Doing so may assist employers in locating blind spots and missed chances in the process.

- For example, if candidates needed to score 80% on the case study, and only five candidates made it through, you may want to change it to 60%.

An interest yielding account is any bank account, personal or business, that pays interest to account holder. In most cases, savings accounts are interest yielding accounts bur checking accounts are not. Obviously, though the $90 bond has a lower face value than the $100 bond, the value of its cash flows is higher, making it more attractive. This is because the value of a bond is equal to its net present value of cash flows.

However, these bonds can also trade on the secondary market, which means investors sell the bonds to each other. If the coupon on a bond issued in the past is higher than the coupon of current bonds, then the value of the “older” bond may actually be more attractive than the new one. As you can see, each loan is first shown at the individual level, then grouped together to show the total value of the loan principal and interest payments.

Strategies to enhance yield involve investment selection, reinvestment, bond laddering, and sector rotation. While enticing, chasing high yields poses risks, such as yield traps and market volatility. High-yield investments often come with increased exposure to market volatility. unearned revenue and subscription revenue While they might offer attractive returns, they can also be more susceptible to market swings, leading to potential capital losses. By shifting investments between sectors based on market cycles and economic conditions, investors can seek out higher-yielding opportunities.

The bottom-most section of each loan section is shown after the impact of the defaulted loans. The ability of a company to access funds or raise capital affects its yield ratio. If it has access to more funds, then the yield ratio will be higher than if it is limited in its resources. A yield ratio helps uncover any interview bias or inherent biases in the recruiting process.

Sometimes, a high yield is a result of plummeting prices due to underlying issues with the investment. The creditworthiness of a bond issuer plays a crucial role in determining yield. Bonds from issuers with higher credit risks tend to offer higher yields to compensate for the increased risk. General market conditions, driven by global events, economic indicators, or geopolitical developments, can sway investor sentiment and impact yields. Factors such as changes in issuer creditworthiness, bond demand and supply, and market speculation can influence bond prices and, subsequently, yields.